If your nearest and dearest possess outgrown your residence and needs more room, you might be questioning: Do you require your own Virtual assistant loan twice? Luckily for us, the answer try sure. You could potentially fix your own full Va financing entitlement from the attempting to sell your own family or repaying the loan in full. As an alternative, you’ll be able to make use of the remaining entitlement amount about purchase of your own first possessions to buy an additional domestic you to definitely better caters to your circumstances.

not, there are certain Virtual assistant financing conditions you will need to see so you can take-out another financial. Let me reveal a good, small help guide to everything you need to know about reusing their Va loan.

Virtual assistant Mortgage Entitlement: How it operates

Their entitlement ‘s the sum of money the new Va will pay to guarantee the loan for those who default involved. Entitlements essentially be sure twenty five% of loan amount, so that they get rid of the significance of a down-payment and personal mortgage insurance policies.

There’s two different types of entitlement which you can located whenever you qualify for a good Va mortgage: earliest and extra.

- Basic entitlement covers 25% of your amount borrowed or $36,000, any type of are less. Basic entitlement only relates to fund to $144,100, in the event. When you need to pick a higher-charged family instead a down payment, you will have to tap into the bonus entitlement.

- Bonus entitlements security 25% of one’s loan amount for the people household pick more than $144,one hundred thousand. There isn’t any higher restrict on purchase price of your home.

Thus even although you inhabit a pricey city, you can easily make use of Virtual assistant mortgage to get a breathtaking possessions for you.

How to recycle the Virtual assistant mortgage work for

Va funds try an existence benefit which you can use in order to change your house since your nearest and dearest and want for room build. When you promote otherwise pay-off your house, you could have the complete entitlement recovered and use it so you’re able to pick a bigger family. If you value to shop for an additional domestic just before selling your basic home, you might be able to use their leftover entitlement to do very. Here is a detail by detail check your alternatives.

Fixing their entitlement just after selling

One of many easiest ways so you can reuse your Va financing was to offer your existing household. You are able to the brand new proceeds from the latest deals to repay the mortgage entirely and ask for that Va Qualification Heart restores your own entitlement. Both the earliest and you may added bonus entitlement are reinstated once your records is actually canned, and will also be prepared to pick a unique fantasy family to have the ones you love.

With your kept entitlement

For many who haven’t utilized your complete entitlement yet, you are capable take-out an extra Va financing buying another type of domestic instead of selling your one to. You will discover if you have burned up your own complete entitlement by the asking for a certificate regarding eligibility regarding Va otherwise performing a little mathematics oneself.

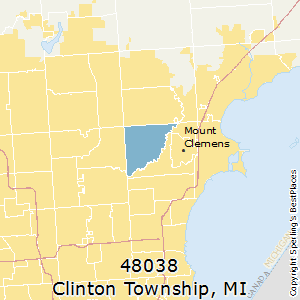

To see just how much of your own entitlement is remaining, you will have to discover conforming mortgage restriction to suit your condition, you’ll find to the Virtual assistant website. Conforming financing limits are definitely the maximum financial number you to authorities businesses like the Virtual assistant are able to back. For each and every condition are tasked the financing restriction to help you take into account variations on the cost-of-living, therefore higher priced portion gets high loan constraints.

The maximum warranty is also a significant factor to look at. Simple fact is that level of their Va mortgage that’s supported by the Va (aka it’s the count they will certainly security for those who default). Having you to support reduces the chance to possess lenders, providing individuals to borrow a lot more within ideal pricing.

Calculate your maximum guaranty from the subtracting the new part of their entitlement which you have currently utilized regarding twenty five% of your compliant loan limit, which is the portion of the financing that Va tend to make sure. Thus, particularly, whether your mortgage restrict on the condition try $510,400, the maximum guaranty might qualify for are $127,600. If you have currently utilized $50,100 of entitlement, their restriction guarantee offered would be $77,600. When you need to purchase an even more costly domestic, you will need to save up having a down-payment of twenty-five% of your loan amount that’s not included in the newest guaranty.

Virtual assistant loan criteria

- Your brand-new house will need to be a primary residence – perhaps not a secondary house or rental assets.

- You will also need to move into your house within 60 days just after closing.

There are particular exclusions to that signal, even when. When you find yourself implemented, exercise off county, otherwise lifestyle somewhere else as you redesign your residence, you could delay occupancy for one year. Your spouse otherwise kid also can meet the occupancy specifications in the event that you happen to be struggling to exercise.

The audience is here to aid

Should your loved ones keeps growing, you don’t have to remain in your existing household. You could potentially recycle your Va mortgage to buy a unique house even although you don’t possess a deposit secured. You can promote your home to get the complete entitlement reinstated, otherwise utilize the remaining amount to let loans your next home get. All you plan to do https://paydayloanalabama.com/dayton/, we within OVM try right here so you’re able to which have any queries you really have and you can direct you from procedure. Contact us or start your application today.