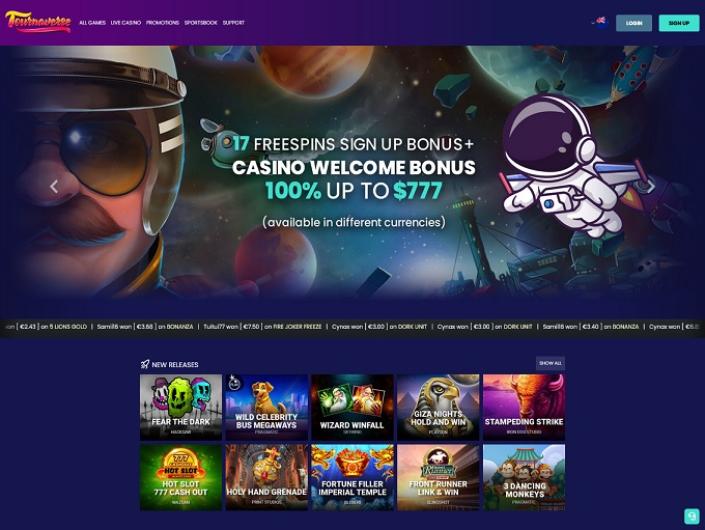

Our required casinos render a wide variety of casino games, along with online slots games, dining table online game, live specialist online game, and a lot more. The newest online roulette games online casino games provided by these casinos are from reputable video game company, such NetEnt, Microgaming, and you can Playtech. Some of the newer apps now run in videos mode and you can breeze the image for your requirements when standards try proper. Financial out of The united states, You.S. Lender and you may Wells Fargo are among the larger banking institutions utilizing the brand-new tech.

Exactly why are an excellent Lender within the 2024, Based on a banking Specialist: online roulette games

Scores of Americans regularly fool around with mobile banking, such as the power to put monitors which have a smart phone. Transferring checks which have a mobile, a pill, or some other mobile device is quick, effortless, safe, and you will easier—and you will eliminates the must go to a part or Automatic teller machine. And, your finances is usually readily available within this two working days. A lot more banks and you will credit unions have to offer mobile look at deposit as the a convenient opportinity for users to add currency to their account.

Around the world Banking

Certain put alternatives provides specific laws and regulations encompassing them that don’t allow it to be bonuses to be claimed. This really is an explanation specific activities bettors you’ll avoid shell out because of the mobile playing. Having two different methods to have deposit and withdrawal is going to be hard because’s not a seamless procedure. Find a very good cellular telephone statement playing internet sites and determine and therefore one we would like to sign up for. You’re going to have to input your own personal information such as label, target, birthday, and much more.

Apple Shell out

There are even reduced put limitations to have online sportsbooks one to take on shell out by cellular. Along with, you usually usually do not create a detachment using this type of strategy. The put and detachment procedures must be various other. Which may be challenging to own another associate out of an on-line sportsbook.

- You’ll become directed so you can snap a graphic of one’s front side and you will straight back of your own look at.

- Hectic designs — probably the speckly cereals of a granite kitchen counter — generate a bad record for a check photos.

- The amount your connect in to the application would be to satisfy the precise quantity of the brand new take a look at.

- Third-team websites could have some other Confidentiality and you will Defense principles than just TD Lender Classification.

- Really monitors has a box noted “recommend right here” or something similar, along with an indicator never to create below a certain section.

The brand new Prompt & Simple way in order to Deposit Checks

- Mobile Look at Put enables you to take an image of one’s front and back of your own endorsed consult the brand new mobile app and your device’s cam.

- Depending on the financial, finance deposited thru cellular consider deposit could be offered just while the next day.

- Gambling establishment labels is even more help the new payment mode, on the greatest labels already are aboard.

- You’ll get the possibility to select and that membership can get the new deposit, like your checking otherwise savings account.

One of the financial institutions that offer mobile look at places is actually Bank from The usa, Chase Lender, Citibank, U.S. Lender, and Wells Fargo. A great many other financial institutions provide cellular view deposit, which is an ever more preferred ability. Mobile consider put uses remote put get technical to help you put the newest view finance into the checking account. That it tool allows banking institutions take on dumps playing with digital photographs of your back and front away from a check as opposed to demanding the initial report take a look at becoming personally placed during the a branch otherwise Automatic teller machine. To get going, you must very first check in due to Online Financial. After allowed, you could deposit and look your reputation of deposited things.

Zero, that you do not spend a fee when you generate a deposit to your your own Investment One user checking otherwise bank account. Very customers has an excellent $six,one hundred thousand daily and you will $ten,000 monthly restrict. Users whom qualify because the a member away from Well-known Banking applications features a $10,100000 daily and you will $twenty five,100 month-to-month limitation. Personal Wealth Administration customers will be get in touch with their Wide range Advisor to have limitations.

Cards & Charges

Cellular deposit concerns transferring a through your financial’s software in your smartphone or any other mobile device. You need to use cellular deposit anyplace you have access to the fresh websites. Once you’ve registered the cellular deposit, the fresh application usually broadcast all the information for the lender and also you would be to find a verification message. Depending on when you deposit the fresh view, it could take a business couple of days for the finance being obtainable in your bank account. Go to the EFTPS site (Come across Resources) and choose the brand new “Enrollment” case.

Put Checks At any place, Anytime

Continue to keep the brand new report look at until you understand the available fund on your membership, just in case anything fails. Pursue cards that you can ruin it just after the cash had been released to your account. When there is a problem with the new deposit, you will found an alternative current email address which explains exactly what the situation try or why the newest deposit is actually declined. The availability of your own financing might possibly be delayed in the event the indeed there’s a problem with the newest put. If in initial deposit has recently published to your account, sign on in order to Wells Fargo On the internet and discover View Facts beside the newest put while you are currently signed to the.