( 5 ) The kind of home payday loans Chicago loan by using the adopting the groups: Important Repaired Payment; Adjustable Speed; Graduated Percentage; Rollover; Other.

( eight ) Whenever borrowing from the bank is actually refuted, copy(s) of your own Equivalent Borrowing Chance Operate borrowing from the bank notice and statement off borrowing from the bank denial.

( 8 ) Any extra information employed by the bank within the deciding whether otherwise to not extend credit, or even in creating the terms, including, yet not restricted to, credit history, a career confirmation versions, Government Tax Forms, method of getting insurance policies, while the over assessment.

27.4 Query/Software Record.

( an effective ) The Comptroller, on top of other things, might require a bank to keep up a reasonable Casing Query/Application Diary (Log), established, not limited by, a minumum of one of the following the factors:

( step 1 ) There’s need(s) to trust your bank could be prescreening if not enjoyable from inside the discriminatory practices into a blocked base.

( 2 ) Grievances submitted on Comptroller otherwise characters in the community Reinvestment Act file can be found as substantive in the wild, proving that the bank’s house credit practices is, or may be, discriminatory.

( step 3 ) Studies of your own investigation authored by the financial institution beneath the conditions of the house Financial Disclosure Operate (several You.S.C. 2801 mais aussi seq. and Controls C of one’s Federal Reserve Board, a dozen CFR area 203) ways a cycle regarding significant version in the quantity of domestic fund ranging from census tracts with the same earnings and you can home ownership membership, classified only from the race or federal resource (we.e., you can easily racial redlining).

( c ) A lender which has been directed from the Comptroller to keep a diary should receive and mention all the following the recommendations from for every query otherwise application to your expansion out of a property mortgage and each query otherwise app for a federal government covered household mortgage (perhaps not otherwise included in this area):

( dos ) Sort of financing with the groups: purchase, construction-permanent; refinance; and you can government covered from the kind of insurance, we.age., FHA, Virtual assistant, and you can FmHA (if the relevant).

( 4 ) Case personality (both a separate matter and that it permits the applying file is receive, and/or name(s) and you may address(es) of your own candidate(s)).

( 5 ) Race/national source of one’s inquirer(s) otherwise applicant(s) using the classes: American indian or Alaskan Native; Asian otherwise Pacific Islander; Black, not of Latina provider; Light, perhaps not off Latina supply; Hispanic; Most other. When it comes to inquiries, which items is going to be noted on the cornerstone of artwork observation otherwise surname(s) simply. In the case of apps, all the information can be gotten pursuant so you’re able to 27.3(b)(2).

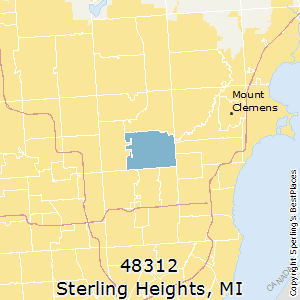

( 6 ) Locationplete physical address, town, condition, state and you may zip code of the house which will hold the expansion out-of borrowing. The brand new census region will even be registered in the event the house is located in an enthusiastic SMSA the spot where the lender has actually a house office or part work environment.

( d ) What requisite around twenty seven.4(c), of this area, is going to be submitted and you will maintained on the function established inside appendix III.

twenty-seven.5 List maintenance several months.

( a great ) Per lender should maintain the ideas requisite not as much as 27.3 to own twenty-five weeks pursuing the financial informs a candidate out of step taken up a loan application, otherwise just after withdrawal away from an application. That it needs and additionally applies to records regarding home loans that are originated because of the bank and you can after that sold.

twenty seven.six Replacement overseeing program.

The latest recordkeeping provisions of 27.step 3 constitute a replacement keeping track of system because registered less than (d) away from Regulation B of your Government Reserve Panel (12 CFR (d)). A bank event the information in the conformity with twenty seven.step 3 of region will be in compliance with the criteria away from regarding Controls B.