Demand because of the email address

step one. Consumer’s fundamental commission authorization or instrument nevertheless needed. This new buyer’s agreement necessary for 1041.8(c) is in introduction to, rather than in place of, any independent percentage authorization otherwise means expected to be purchased from the user not as much as appropriate legislation.

step one. Standard. Area 1041.8(c)(2)(i) sets ahead the overall needs that, to possess reason for the fresh new different during the 1041.8(c), this date, amount, and you can payment station of each and every extra commission transfer must be signed up because of the consumer, susceptible loan places Belgreen to a finite difference in the 1041.8(c)(2)(iii) for percentage transmits solely to get a late payment or returned goods payment. Accordingly, toward exclusion to put on so you can a supplementary payment import, the brand new transfer’s particular time, number, and fee station need to be within the closed consent received about consumer below 1041.8(c)(3)(iii). To have strategies for the requirements and issues that incorporate when obtaining brand new buyer’s finalized authorization, discover 1041.8(c)(3)(iii) and you can accompanying comments.

Certain time

2. The necessity that certain date of any extra commission transfer be approved by the consumer was found in the event the user authorizes the new week, date, and season of each import.

3. Matter bigger than specific amoun t. The fresh exemption from inside the 1041.8(c)(2) doesn’t pertain whether your bank initiates a fees transfer to possess a price bigger than the amount authorized by the user. Consequently, particularly a move carry out violate brand new prohibition on the more payment transfers under 1041.8(b).

4. Less. A repayment import started pursuant to 1041.8(c) is set up for the certain quantity authorized by the consumer if the amount is equal to otherwise smaller than the latest subscribed amount.

step one. General. When the a lender gets the newest consumer’s consent so you’re able to initiate an installment import solely to get a late commission or came back items payment in accordance with the standards and you will requirements lower than 1041.8(c)(2)(iii), all round requirement for the 1041.8(c)(2) that consumer approve the specific date and you can quantity of per a lot more payment transfer need not be fulfilled.

2. Higher matter. The requirement that the buyer’s signed consent tend to be a statement that determine the best matter that can be energized to have a later part of the percentage or returned product fee is actually found, such as, whether your report specifies the most let in mortgage arrangement for a safeguarded financing.

3. Differing commission wide variety. When the a charge number can vary as a result of the leftover mortgage balance and other factors, brand new signal requires the financial to visualize elements you to definitely effects in the large count it is possible to into the calculating the desired count.

step 1. General. 8(c)(3)(ii) to help you request a consumer’s consent to your or adopting the time you to the lender comes with the consumer legal rights notice necessary for 1041.9(c). For the exemption inside 1041.8(c) to utilize, however, the newest client’s closed authorization should be acquired zero earlier than this new big date about what the consumer is known as to have gotten new user rights notice, as specified inside 1041.8(c)(3)(iii).

2. Different options. Absolutely nothing in 1041.8(c)(3)(ii) prohibits a lender out-of delivering different alternatives toward consumer to help you believe depending on the time, count, or payment route of any more commission import in which the brand new bank are asking for authorization. On the other hand, in the event the a buyers declines a consult, absolutely nothing inside 1041.8(c)(3)(ii) forbids a lender from and work out a follow-up consult by giving an alternative selection of terms and conditions into the user to adopt. Eg, in case your user refuses a first consult in order to authorize a few continual fee transmits to own a certain number, the financial institution will make a follow-upwards request the user so you’re able to approve three repeated payment transmits for a lesser amount of.

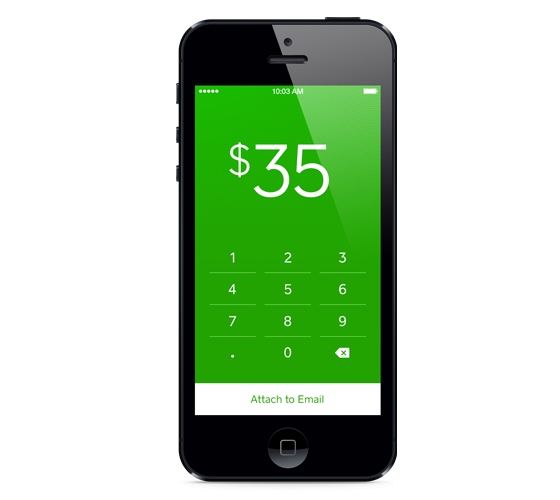

step 1. Under 1041.8(c)(3)(ii)(A), a lender are allowed to provide the required terminology and you can declaration into consumer in writing or perhaps in an excellent retainable function by the current email address in the event the consumer enjoys agreed to discovered electronic disclosures from inside the that trends not as much as 1041.9(a)(4) or believes to receive the latest conditions and you may statement by email address inside the category regarding a relationship initiated by consumer as a result toward individual rights notice necessary for 1041.9(c). Another analogy illustrates a posture in which the user believes to get the desired words and you may declaration from the current email address immediately after affirmatively responding to the new observe: