Homeownership are going to be an important part of the fresh new Western dream as an easy way to create riches towards lasting and create balances on your profit. Although many carry out-end up being home buyers is within the myth one loans Riverside to to buy a house may be out of take people who have disabilities, that could never be further on details.

Actually, there are various home loan choices for those with disabilities. We’ll speak about the options and you can express tips about simple tips to effortlessly contain the financial you are searching for.

The major Impairment Home loan Applications Consumers Need to know From the

Early considering additional residential property, you need to understand the sorts of applications that exist so you can. When you are able to submit an application for one home buying system you to definitely s positioned that can help consumers which have disabilities get into home quicker.

Fannie mae

Fannie mae, otherwise known as the new Fannie mae, is actually a federal government-work at team that provide sensible housing solutions. Two of the top programs would be the Fannie mae HomePath In a position Customer program, which will help first-time homebuyers purchase foreclosures, plus the Federal national mortgage association HomeReady program, that allows one another basic-some time repeat home buyers to invest in home that have only a small amount once the step three% down. While you try not to yourself discover financing away from Federal national mortgage association, you might safer you to through a lending company that is protected because of the Fannie mae.

- A credit history off 620 or even more

- A debt-to-money ratio out-of lower than forty five%

- A downpayment between step three% 5% able

- two or more weeks off mortgage repayments protected

Though there are a few financing restrictions based on your area, this can be a beneficial option for grownups which have disabilities you to features a reduced income. The fresh certification standards be a little more relaxed in addition to program can assist you have made towards the yet another family even although you don’t possess a huge down payment secured.

FHA Fund

FHA money are usually shown just like the good option for someone having a lowered credit rating. Mainly because funds try supported and you can covered of the Government Construction Administration, consumers have access to lower down commission selection.

- A credit score of at least 580

- An obligations-to-income proportion away from lower than 45%

- A down-payment with a minimum of step three.5%

Brand new FHA mortgage program lets home buyers having shorter-than-finest borrowing to help you qualify for resource. When you’re concerned with your credit rating and do not think you’ll be eligible for a different sort of financial, a keen FHA loan may be the right choices.

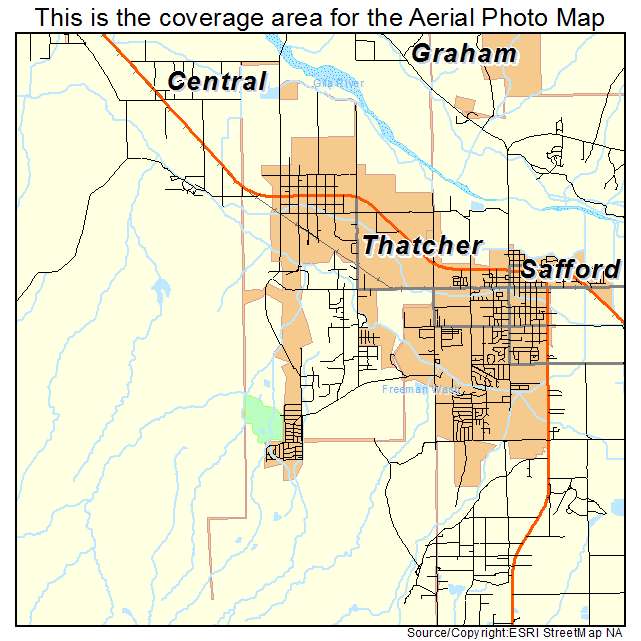

USDA Home loans

The brand new U.S. Department out-of Agriculture (USDA) also provides a home loan program that might be a beneficial possibility having grownups with handicaps.

Brand new Homes Guaranteed Loan Program is made for solitary-family members property. By this system, low- and reasonable-money candidates you to definitely inhabit eligible rural areas can also be qualify for a home loan. So you’re able to meet the requirements, you will have to match the following requirements:

- Enjoys an income fits the fresh qualifications requirements

- Choose property which is in a qualified rural city

Y ainsi que may a USDA mortgage courtesy a lender having zero deposit for many who meet the requirements. Skyrocket Home loan will not give USDA funds nowadays.

Va Funds

When you’re a handicapped seasoned, an excellent Va mortgage could be the perfect complement. To qualify for a Va mortgage, that’s protected through the Service out-of Pros Factors, you will have to meet with the after the criteria:

T let me reveal zero minimal credit rating demands lay by the Va otherwise restrictions intent on the debt-to-earnings ratio. Loan providers tend to set their requirements, but these will likely be more enjoyable compared to criteria regarding a conventional mortgage.

County Agency Direction

Past federally recognized fund, of many state enterprises also provide financial options to have adults with disabilities. Whilst guidelines and requirements are different according to research by the county, it may be recommended to look to your.

Several claims that provide assistance to adults having disabilities seeking homeownership tend to be Maryland’s Homeownership for folks which have Disabilities Program and you may Connecticut’s Family of one’s System.

Including mortgage programs, of numerous claims provide assets income tax exemptions to those that have disabilities. Speak to your regional taxation and you may cash department to see if indeed there was the opportunity to save.

Nonprofit-Supported Fund

Government software aren’t the only option for individuals with disabilities looking to homeownership. Thank goodness, there are nonprofit-supported loans because of of a lot groups, including: