Do it yourself Mortgage Cost

The particular rate and you can title might possibly be dependent upon your borrowing from the bank get, guarantee worth, matter funded, or any other circumstances. Points, prices, and terms and conditions is actually susceptible to changes instead prior see; other restrictions get apply. Financial financing is restricted to help you assets during the Texas. Possessions insurance is necessary, along with flooding insurance coverage in which appropriate. Valid to possess number one houses only. Mortgage may not be familiar with buy the property used due to the fact guarantee.

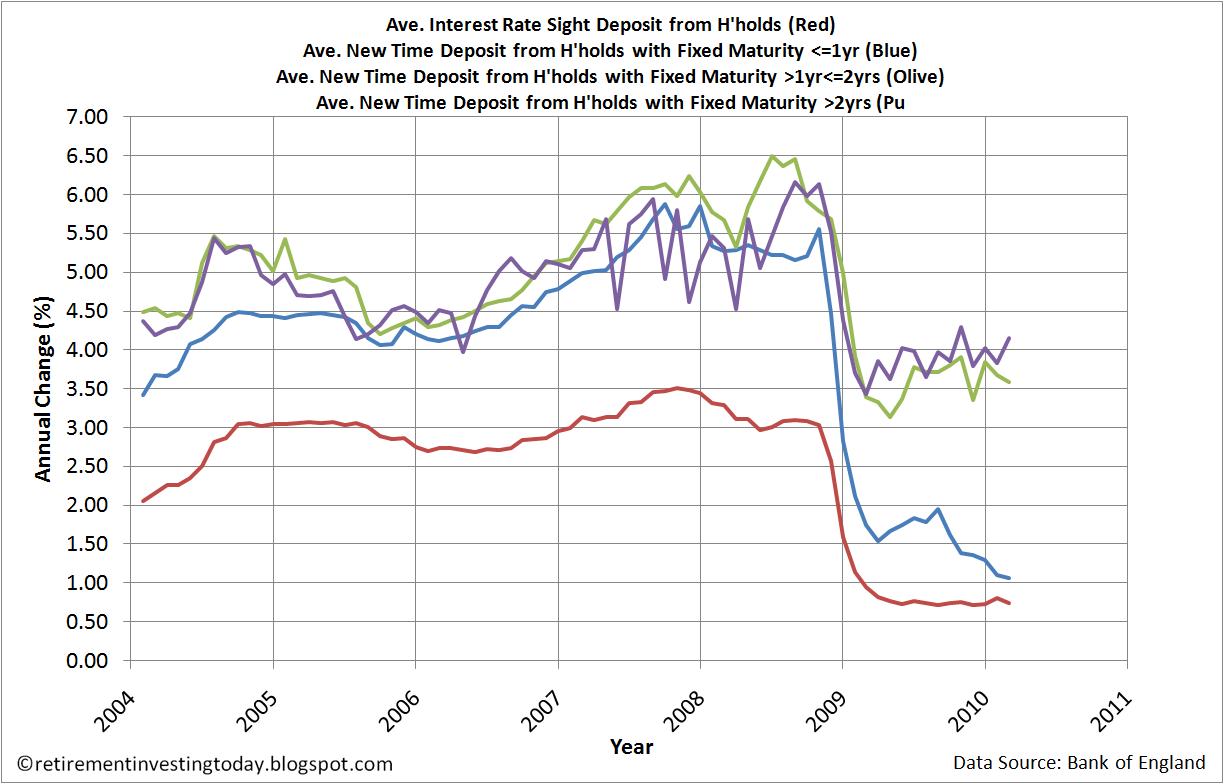

1. Apr (. Your final Annual percentage rate may vary centered on traditional fees and you may closure costs being curable due to the fact attract when calculating your final ount is $twenty five,000 to own very first-lien household security loans; terms and conditions around thirty years on first lien household collateral loans. Family Collateral funds is limited to 80% of your own house’s reasonable market price reduced the brand new stability of any outstanding liens. User will get bear one to-big date possessions taxation monitoring fee and will pay additional third-party fees. These costs typically dont go beyond $. Member incurs price of full title plan toward money more than $150,000. A sample financing payment getting a fixed equity financing considering good $100,000 at 6.333% ple does not include numbers to have fees and you can insurance premiums, of course, if appropriate, the real fee duty would-be greater. Continuar leyendo «Fund at the mercy of borrowing from the bank and you may possessions recognition, most other small print apply»