What is Apr (APR)?

Annual percentage rate (APR) refers to the annual desire created by a sum that’s billed so you can consumers or reduced to help you investors. Apr try indicated once the a percentage you to definitely is short for the true yearly cost of financing along the term off that loan or earnings attained to your a financial investment. This can include people fees otherwise additional costs associated with the order but does not grab compounding under consideration. The new Apr will bring people which have a bottom-line number they can evaluate one of loan providers, playing cards, otherwise investment things.

Secret Takeaways

- An apr (APR) is the yearly rates billed for a financial loan or attained from the a good investment and you may comes with notice and you will charge.

- Loan providers need to disclose an economic instrument’s Annual percentage rate before every arrangement was closed.

- This new Annual percentage rate brings a frequent reason for presenting yearly interest advice in order to cover people off misleading advertising.

- An apr will most likely not echo the genuine price of credit since lenders has a fair level of flexibility for the calculating they, leaving out specific charge.

- Annual percentage rate really should not be confused with APY (annual percentage yield), a formula which will take new compounding interesting into account.

The way the Annual percentage rate (APR) Functions

An apr was conveyed because the an interest rate. They exercises just what portion of the primary you’ll be able to spend yearly by firmly taking things like monthly payments and you can fees into account. Apr is even new annual interest rate repaid with the investments instead of bookkeeping towards compounding interesting inside one seasons.

The actual situation into the Lending Operate (TILA) of 1968 mandates you to definitely loan providers disclose the latest Annual percentage rate it charge to individuals. Credit card issuers can highlight interest rates to your good monthly foundation, nevertheless they have to demonstrably declaration new Apr so you can people prior to they indication a binding agreement.

Credit card companies can increase the interest rate for brand new instructions, however current balance when they provide you with payday loan companies in Fort Pierce South FL forty-five days’ notice first.

Just how Is Apr Computed?

Annual percentage rate is computed by multiplying the newest occasional interest by level of attacks during the a-year in which it absolutely was applied. It will not indicate how often the rate is actually put on the balance.

Brand of APRs

Bank card APRs differ based on the particular costs. The credit card issuer can charge you to Apr for orders, a separate for money improves, and yet another type of to possess transfers of balance away from another type of card. Issuers along with fees highest-rates punishment APRs to help you consumers getting late money otherwise violating most other regards to the new cardholder arrangement. There is the fresh basic Annual percentage rate-a minimal or 0% rate-in which of several credit card companies you will need to draw in new customers to join a credit.

Loans from banks basically have possibly fixed or adjustable APRs. A predetermined Apr loan has an interest rate that is protected to not transform from inside the lifetime of the loan otherwise borrowing business. A changeable Annual percentage rate financing is interested price that may change anytime.

Brand new Annual percentage rate borrowers is actually billed including utilizes the borrowing. Brand new rates open to people with advanced level borrowing is actually rather straight down than those offered to people who have less than perfect credit.

Substance Attract otherwise Easy Attract?

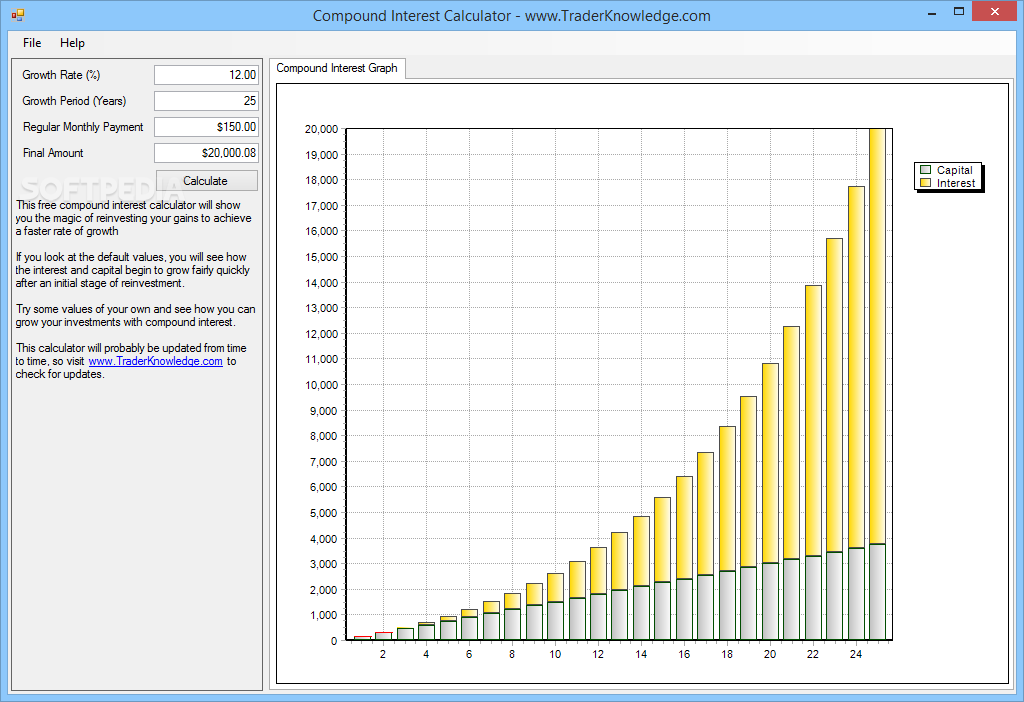

Annual percentage rate doesn’t think about the compounding of great interest within a certain seasons: Its built only into the easy focus.

Annual percentage rate against. Annual Commission Yield (APY)

Though an apr simply accounts for simple notice, the annual percentage yield (APY) takes substance focus into account. Because of this, a good loan’s APY is higher than their Apr. The greater the rate-and also to a diminished the total amount, small the fresh new compounding periods-the greater amount of the essential difference between the fresh Apr and you will APY.