Antique loans was a well-known replacement FHA money. Rather than FHA funds, they are not supported by the government, and therefore capable has actually some other standards plus autonomy when you look at the certain areas.

Such, traditional funds don’t have the exact same possessions limitations once the FHA fund, which makes them an appropriate choice for those people seeking buy leasing attributes otherwise purchase an extra family. However, they often require a higher credit score and you will a larger off payment.

Va Funds

A beneficial Va loan could well be a great alternative while a seasoned, active-duty services representative, otherwise an eligible friend.

Va finance, backed by the new Agencies from Experts Witches Woods loans Facts, commonly offer favorable words, such as no downpayment and no individual mortgage insurance rates (PMI).

Nevertheless they don’t possess a particular rule regarding rental income or running multiple features, making them a whole lot more flexible for those seeking to circulate without promoting its most recent family.

USDA Financing

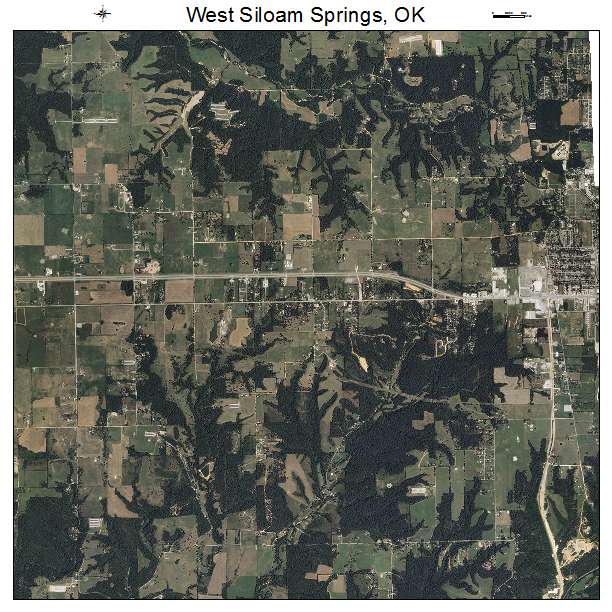

USDA loans is a nice-looking selection for homebuyers during the outlying portion. This type of fund are supported by the us Agency of Agriculture as they are made to promote homeownership into the reduced heavily populated section.

They give you perks such as for instance no down payment and lower mortgage insurance policies can cost you. But not, they are available having specific qualification conditions pertaining to money in addition to property’s place.

Collection Finance

This type of money could offer alot more independence off underwriting requirements, which makes them a great fit getting borrowers with unique things, such a property people otherwise individuals with changing incomes.

HELOC or Household Collateral Financing

For people who already very own a property and now have built up guarantee, a house collateral line of credit (HELOC) otherwise a property guarantee mortgage you will provide the loans needed for your brand new household buy.

Such choices enables you to borrow secured on the new collateral on your own current assets. They truly are such as for instance beneficial for individuals who eventually decide to promote your current household but you need funds.

Non-Qualified Home loan (Non-QM) Fund

Non-QM financing can handle borrowers who don’t match the average credit requirements. This type of you will is notice-working some body or people who have low-conventional income present.

Non-QM finance could offer far more flexible earnings verification process however, often feature higher rates and you may down payment requirements.

To help explain these types of subject areas, we have built-up a summary of Faq’s (FAQs) you to target some of the even more nuanced aspects of this laws and its impact on FHA loan individuals.

Should i rent my personal newest house under the FHA 100-Distance Laws in the place of impacting my new FHA mortgage?

Sure, you could potentially rent out your family, but if its inside 100 kilometers of the new home, the local rental earnings might not be felt on your own the brand new FHA mortgage certification.

Do brand new 100-Mile Code pertain when selecting an extra family as the a holiday property?

FHA loans are mainly getting number 1 houses. Whenever you are to buy a vacation domestic, the new 100-Mile Signal in order to have several FHA funds normally doesn’t pertain, given that FHA financing are not designed for travel qualities.

How is the 100-mile distance measured toward laws?

This new 100-mile distance is generally mentioned in the a straight line («as the crow flies») from your most recent no. 1 residence towards the fresh new residence.

What if I move around in to have a job below 100 miles away?

When your work moving is less than 100 far off, you might face challenges in the qualifying to own an additional FHA financing, as 100-distance Laws perform fundamentally perhaps not incorporate.

Should i attention this new FHA’s decision when the I’m refuted a loan due to the 100-Distance Code?

While you are there isn’t an official notice process, you might consult with your bank to possess advice on your position. They may recommend solution paperwork or mortgage selection.