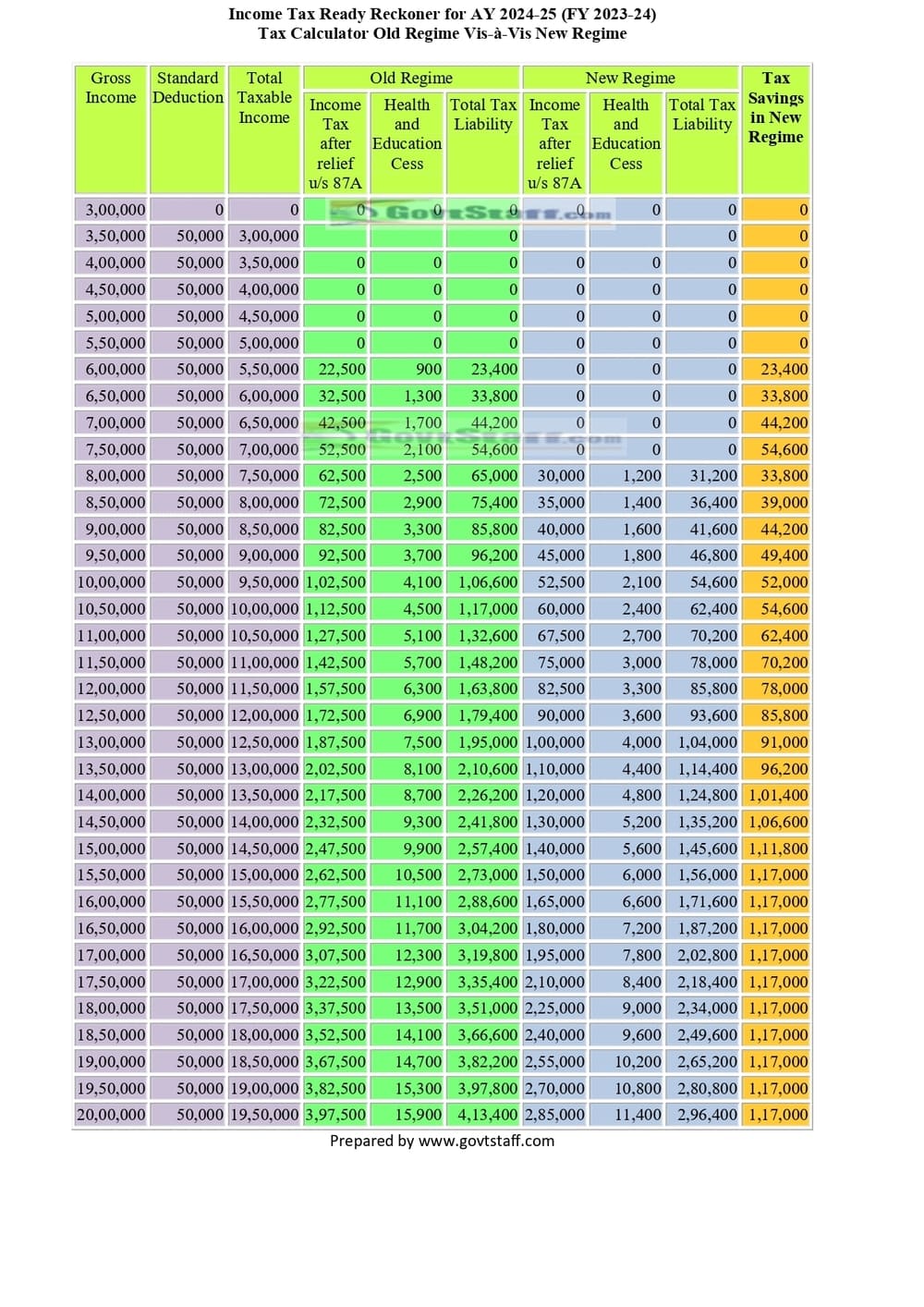

Table from Content

- What is actually a conforming Financial?

- What exactly is a conforming Home loan?

- What is the Difference between Compliant and you may Conventional Money?

- What’s the Antique Conforming Financing Maximum?

- Takeaways

- Sources

REtipster doesn’t offer tax, resource, otherwise financial advice. Always seek the assistance of a licensed economic elite before you take step.

What is a conforming Financial?

- Fannie mae and Freddie Mac’s guidelines getting funding unmarried-family relations belongings.

- The latest Federal Homes Financing Service (FHFA) set the loan constraints.

Federal national mortgage association and Freddie Mac computer incentivize lenders exactly who follow their legislation by buying the house financing they situation. These authorities-sponsored organizations (GSEs) repackage new mortgage loans towards the bonds market them to dealers. Compliment of these types of GSEs, conforming loan companies can certainly continue borrowing from the bank to homebuyers as well as have mortgage loans off their balance sheets.

- The mortgage cannot exceed the latest money cap lay because of the federal government from the county where property is discovered.

Differences That have a Nonconforming Mortgage

While doing so, nonconforming mortgage loans features some other degree standards because they go beyond the loan restrictions lay by the FHFA. That is why nonconforming lenders along with go-by title jumbo mortgage loans.

Considering the matter, nonconforming fund are too highest to possess Federal national mortgage association and you will Freddie Mac to acquire. Without any backing out-of GSEs, nonconforming lenders is motivated to fees highest rates of interest and then make right up with the higher risk they want to need.

Conforming fund and you may conventional financing are two other terms and conditions. For starters, the conforming mortgage loans is old-fashioned, not loan for dental work all traditional mortgage loans was conforming.

Since the Fannie mae and Freddie Mac are officially individual organizations, whether or not it solution to the fresh new FHFA, any financing they straight back is recognized as a conventional mortgage.

Indeed, nonconforming mortgages is antique loans themselves once the no alternative party establishes the qualification guidelines for these mortgage brokers. The lenders-which can be individual organizations-alone call this new photos. They’re able to lend as much as they require also to whomever they require.

Are a keen FHA Loan a compliant Loan?

While FHA and you can conforming mortgage loans do not get into a similar classification, both will help Western users, specifically millennials, beat a few of the common obstacles in order to getting a house.

Significantly more millennials usually choose compliant mortgage loans more FHA of these. Among the many it is possible to grounds is the quite reduce payment requisite compliant home loans enjoys.

Subprime Financing compared to. Compliant Loan

Good subprime loan is out there so you can anyone which have a credit score lower than 620. Referring with a high attract to pay the lending company to have extending borrowing from the bank to a borrower whose listing implies that the likelihood of later commission and you will default is actually high.

Since the minimum credit score element compliant mortgage loans was 620, they may never be associated with subprime rates of interest.

Borrowers with credit ratings regarding 620 or more than will be thought near-best, primary, or super-best. Whatever the classification this type of homebuyers fall under, he is into the a soft status so you can negotiate to own beneficial interest because an incentive because of their creditworthiness.

What is the Conventional Conforming Mortgage Limitation?

Just the right address depends on two things: the full time of the year while the precise location of the home. Here is a review of for every element.

Time of the year

The us government kits the brand new conforming financing limitations a year making use of the Home Rate List. In the past, policymakers made use of brand new Monthly Rate of interest Questionnaire. The latest FHFA adjusts maximum compliant loan limits to help you reflect the fresh new improvement in the typical home prices over the All of us away from the prior season.

Which government agency announces the mortgage ceilings in the last quarter of your most recent seasons considering house prices for the fresh early in the day four home.

The initial one relates to all You.S., while the second is set aside having come across areas otherwise state-competitors, especially in places that nearby median household well worth are large than the standard maximum of the 115%.

Place

Brand new threshold of your compliant financing restrictions in the high priced parts are 150% of your baseline restriction. The home funds awarded utilizing the higher restrict limitation aptly try called extremely compliant money.

As a result of the specifications according to the Homes and you can Monetary Healing Act of 2008, Alaska, Hawaii, Guam, therefore the U.S. Virgin Isles stick to the high restriction compliant amount borrowed cover.

Furthermore, the latest compliant financing limitations increases or decrease. They’re able to also stagnate, particularly how it happened off 2006 so you’re able to 2016 when the baseline limitations getting unmarried- and you may multiple-unit services stayed unchanged within $417,000.

When the conforming financing ceilings will in all probability plunge, particular loan providers also begin to accept huge applications before the government department tends to make a formal announcement.