Whether it’s the dream of owning a home often necessitates financial support in the form of a mortgage . Amidst the plethora of financial terms and considerations, understanding the correlation between CTC (Cost To Company) and home loans is crucial. Let’s understand how CTC influences the home loan process and what factors borrowers need to consider.

Role from CTC home based Mortgage Qualification

Money Investigations : Lenders evaluate borrowers’ qualification to own home loans considering the earnings. CTC functions as a crucial metric contained in this evaluation, taking understanding toward borrower’s earning potential and you will economic balances.

Debt-to-Money Ratio (DTI): Loan providers think about the borrower’s DTI proportion, and this measures up their total monthly loans costs on the gross monthly earnings. CTC models the origin of this computation, as it means the brand new borrower’s total money.

Loan amount Calculation: Maximum loan amount a borrower qualifies for relies on its money, having CTC being a first determinant. Lenders generally speaking offer loans according to a particular part of brand new borrower’s income, making certain that brand new monthly money continue to be sensible.

Impression regarding CTC Elements to your Mortgage Recognition

Earliest Salary : Lenders commonly focus on the borrower’s first paycheck whenever examining the repayment ability. A higher earliest paycheck ways a healthier monetary status and may even improve the odds of mortgage acceptance.

Allowances and you may Incentives : If you’re allowances and you may incentives sign up for brand new CTC, lenders get scrutinise such components in different ways. Typical and you can secured allowances are thought even more favorably than just adjustable bonuses, while they provide a stable source of income to have financing money.

Stability and Texture : Loan providers like borrowers that have a steady and you will consistent income stream, since it helps to control default. People who have changing CTC areas must bring even more paperwork otherwise have shown a normal income background so you can safe mortgage recognition.

Optimising CTC to possess Financial Acceptance

Paycheck Construction : Consumers can be smartly build its paycheck parts to enhance its qualification to possess home loans. Improving the proportion off very first salary prior to allowances and you may bonuses is also bolster the payment strength on the sight out-of loan providers.

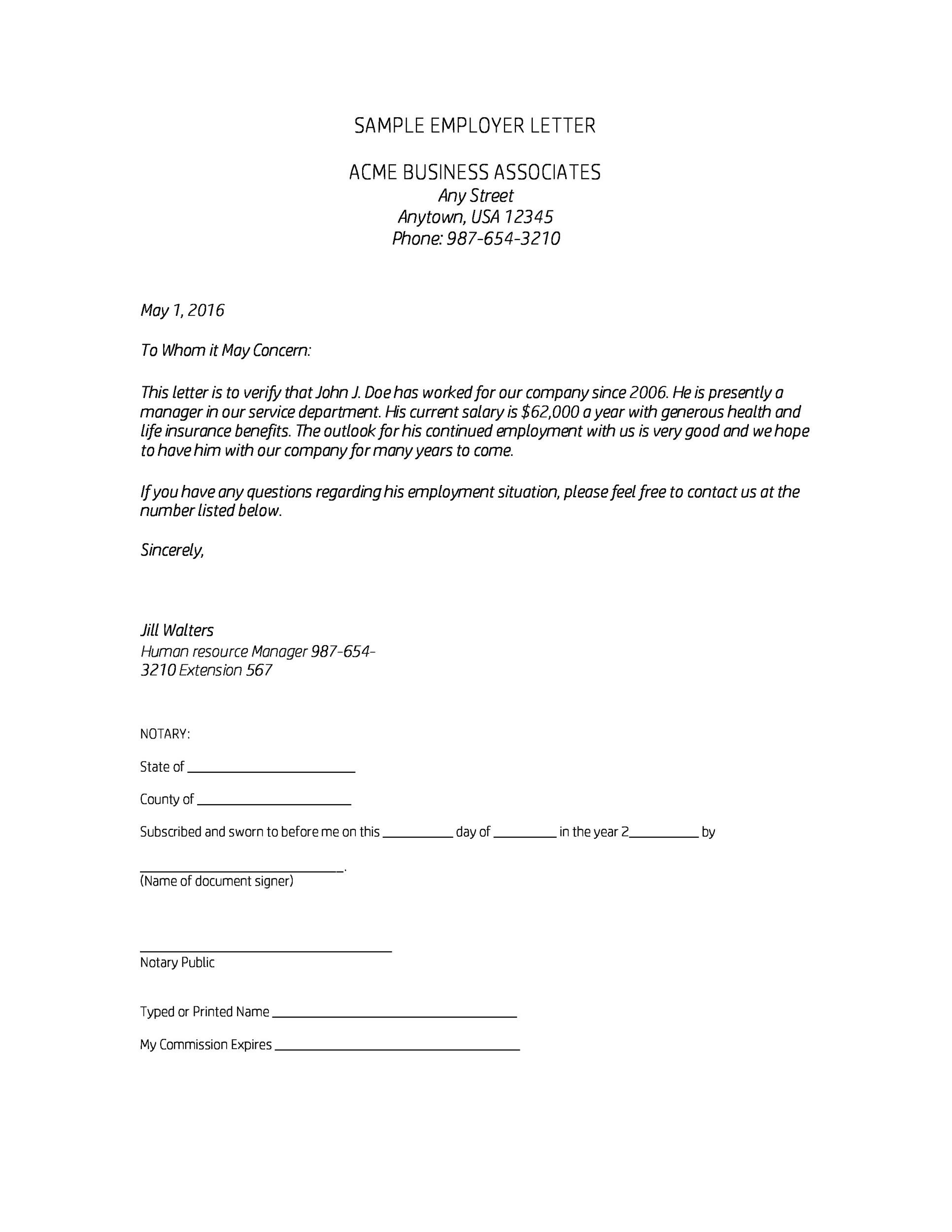

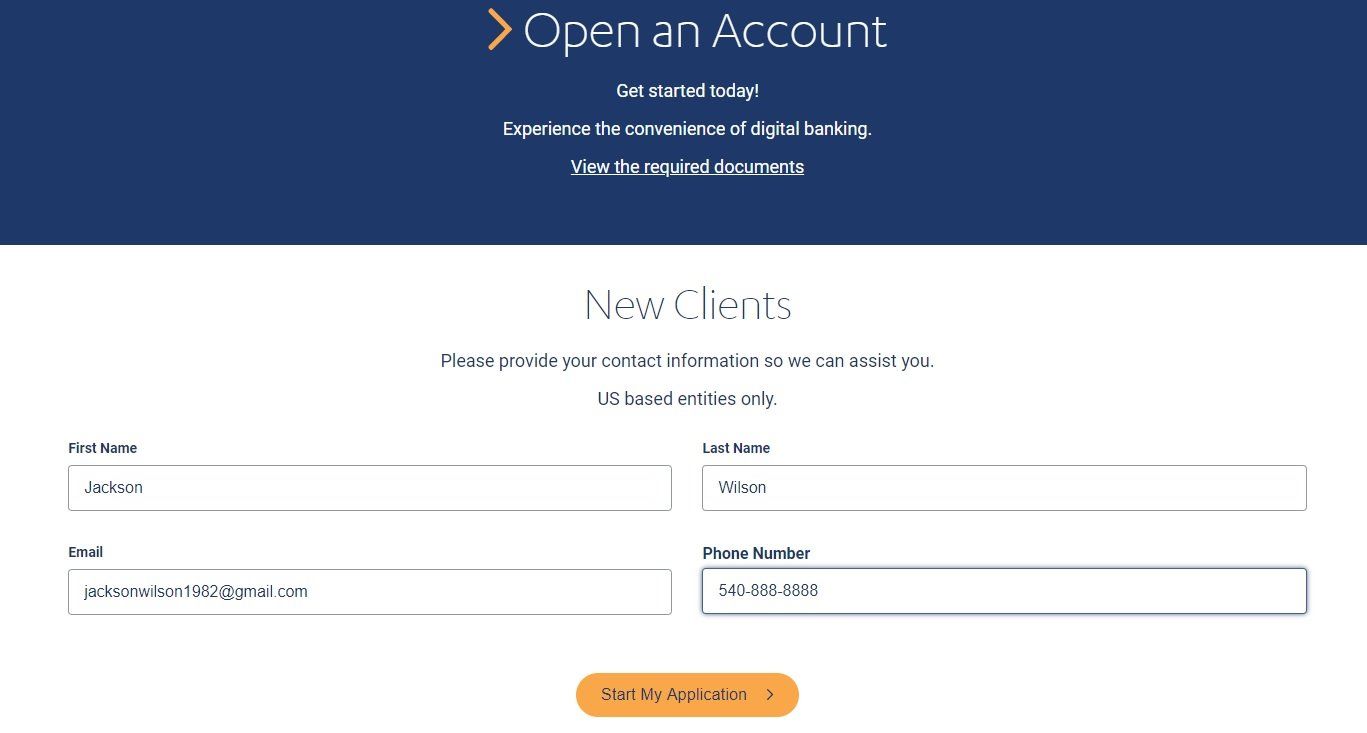

Documentation Confirmation : Ensuring direct and total documents from CTC elements is very important through the the house application for the loan techniques. Loan providers get demand evidence of earnings, such as for instance paycheck slips, income tax yields, and employment agreements, to ensure this new borrower’s monetary credentials.

Financial obligation Administration : Dealing with present debts and you can debts is extremely important for maintaining a wholesome DTI proportion and you will improving mortgage eligibility. Borrowers is to try and minimise a good bills and steer clear of taking on brand new financial obligations just before trying to get a home loan.

Real-Lifestyle Application: Navigating Home loan Recognition having CTC

Consider the situation out-of Rohan, who want to buy 1st domestic. Rohan’s CTC is sold with a hefty first paycheck and changeable incentives and you may allowances. To compliment his home loan qualification, Rohan chooses to discuss together with his manager to increase his earliest salary while maintaining a competitive full CTC.

Abreast of obtaining home financing, Rohan provides complete documents away from their income, including salary slips and tax returns. Their steady money records and you may smartly arranged CTC elements appeal the newest bank, resulting in swift approval regarding his financial application.

End

CTC performs a crucial character within the determining a person’s qualification to own lenders giving skills into their money and you will monetary balances. Focusing on how CTC influences your house mortgage procedure empowers consumers in order to optimize their financial profile and improve their chances of financing recognition. Of the strategically managing its income portion, documenting its income truthfully, and you will keeping a healthy financial obligation-to-income ratio, some one is browse the newest ins and outs away from mortgage approval with full confidence and you will success.

Basically, CTC functions as an extensive construction having contrasting and you can facts a keen employee’s full payment plan. By deciphering its meaning and you will analysing its important factors, anybody helps make told conclusion out-of occupations offers, salary negotiations, and you may monetary planning. Understanding the nuances out of CTC empowers teams https://availableloan.net/loans/sunday-payday-loans/ so you can browse this new state-of-the-art land off corporate settlement confidently and you will understanding.