Choosing the right financial can notably impact your financial coming and you may homeownership experience. To support it vital decision, we’ve gathered a relative studies from Virtual assistant Loans vs most other well-known home loan models.

This review is designed to stress key distinctions and you may parallels, providing a very clear, to the level snapshot so you’re able to navigate the options.

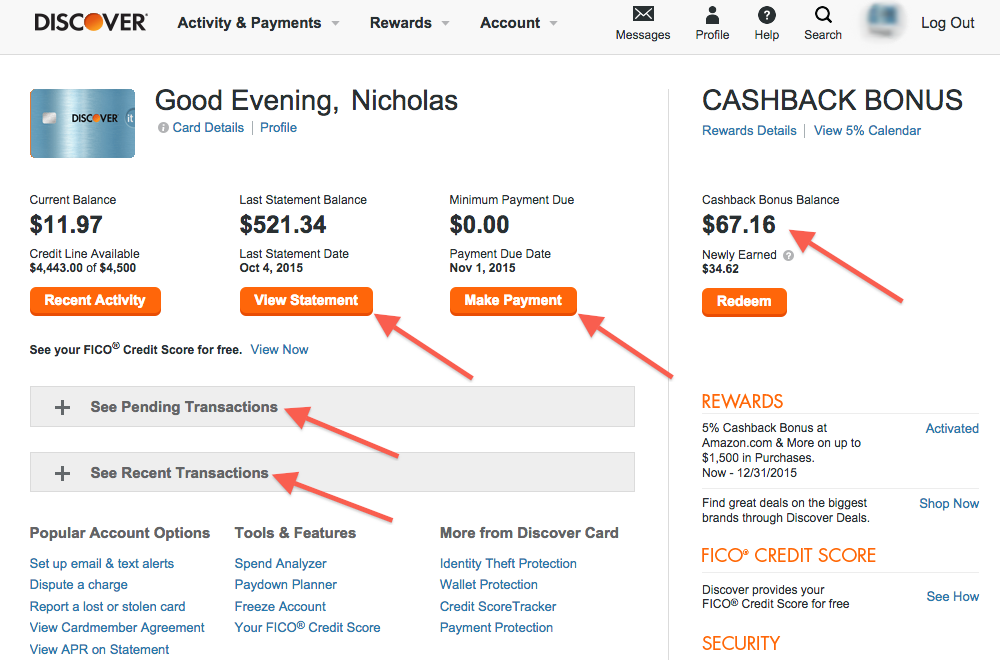

Below was a dining table that traces one particular issues of each and every. This graphic publication is designed to make clear state-of-the-art suggestions, which makes it easier about how to weigh the pros and disadvantages of every mortgage form of without delay.

Take note that advice offered inside desk are a great standard book. Rates is change centered on market conditions and you may private bank procedures, and qualifications standards could have most criteria maybe not fully captured right here. Comprehend all of our self-help guide to navigating latest mortgage prices to find out more.

Which research will act as a kick off point on your own look, and now we encourage one take a look at per alternative further, particularly when you to definitely generally seems to align along with your financial predicament and you can homeownership requires.

If your really worth the fresh new no deposit element from Va and you may USDA Funds, the flexibility regarding Conventional Funds, or perhaps the use of from FHA Financing, there is certainly home financing alternative designed into the unique needs and points.

In-Depth Evaluation

Now it’s time to visit a tiny higher and you can speak about this type of mortgage solutions. Let’s strip right back the brand new layers each and every mortgage type of, investigating their unique provides, experts, and you will possible drawbacks.

The mission is to help your which have a comprehensive knowledge of how these financing disagree in practice, not simply in writing, so you’re able to take advantage of informed decision customized on the novel homebuying needs and you will monetary things.

Va Funds vs Old-fashioned Financing

When selecting the best home loan, understanding the secret differences when considering Va Loans and Antique Finance was crucial for experts and effective armed forces people. Each other loan types give unique experts and you can factors customized to meet up with varied economic products and homeownership goals.

Down-payment

Among the many differences when considering Va Funds and you may Old-fashioned Finance will be based upon the newest advance payment criteria. Virtual assistant Money is celebrated because of their 0% deposit work for, giving unmatched use of homeownership for those that have supported. Having said that, Traditional Loans usually need a deposit ranging from step 3% so you’re able to 20%, according to the lender’s criteria and the borrower’s creditworthiness.

Financial Insurance policies

A separate important element ‘s the dependence on financial insurance coverage. Virtual assistant Finance do not require individual mortgage insurance coverage (PMI), regardless of the deposit matter, that end in large monthly coupons to you. Old-fashioned Loan customers, on the other hand, need to pay PMI if its down payment was lower than 20% of your house’s price, including an additional expense up until the mortgage-to-worth ratio are at 80%.

Interest levels

Rates of interest for Virtual assistant Money are usually less than those individuals to have Conventional Money, due to the authorities support. This can lead to lower monthly payments and tall discounts more the life of your own loan. Old-fashioned Mortgage pricing have online payday loan Ridgebury CT decided by the borrower’s credit history, deposit, loan label, or other products.

Borrowing Standards

Va Loans are significantly more flexible having credit requirements, enabling pros and you may productive armed forces participants which have lower credit scores so you’re able to still be eligible for home financing. Antique Financing, yet not, tend to have more strict credit score criteria, have a tendency to requiring a rating from 620 or maybe more to own acceptance.

Financing Limitations

While you are Va Fund used to have limits centered on condition direction, alterations in modern times enjoys removed financing restrictions to possess consumers which have complete entitlement, permitting the credit out-of land in the high rates situations without a downpayment. Antique Loans, but not, adhere to mortgage limits set because of the Government Houses Loans Institution (FHFA), that are different from the condition and they are adjusted a-year.