Are you currently perception overloaded because of the possessions income tax debts? You’re not by yourself. Of numerous home owners inside the Canada fall loan places Madeira Beach into a hard destination when it comes to expenses assets taxes. But never proper care, there’s a simple solution! House equity financing would be the lifeguards. Let us diving on the how you can tackle property tax challenges direct-into.

What goes on If you’re unable to Shell out Property Taxation inside Canada?

Possessions taxation was a well known fact off lifestyle for residents in the Canada. This type of taxation funds important functions such as for instance universities, tracks, and you will disaster qualities. But what when you are incapable of pay? This example might be stressful, but it’s important to understand the outcomes and you may offered possibilities.

If the assets taxes commonly reduced timely, the local government get enforce later costs and you can appeal. Ultimately, continued non-fee can cause much more serious consequences, instance a good lien against your residence. This means the us government possess an appropriate claim to your home on account of unpaid expenses. To stop these circumstances, it is vital to look for options early.

Just how long Could you Forgo Using Property Taxes within the Ontario?

For the Ontario, the fresh new schedule to possess outstanding possessions taxes is fairly rigorous. Just after shed an installment, you can deal with immediate punishment and you will focus. If the taxation will still be unpaid-for a specific period, constantly 24 months, the newest town can begin the procedure to sell your house so you can recover the brand new owed fees.

This could voice frightening, however, remember, there are ways to perform this example. And that will bring us to a simple solution many Canadians is turning to family guarantee capital.

Knowledge Home Equity Capital

Household security investment comes to borrowing from the bank currency from the worth of your own home. Think of your home just like the a financial investment. Through the years, since you pay back the mortgage along with your property’s well worth develops, your make security. That it collateral is the difference in your residence’s well worth in addition to a great financial count.

Home security financial support can come in almost any forms, including a property Equity Credit line (HELOC) otherwise the second mortgage. These types of solutions can supply you with the income had a need to spend out of your property fees.

Why Prefer Household Equity Financing to possess Possessions Tax Payments?

- Quick access in order to Financing: Family collateral resource could possibly offer an easy solution to settle an excellent property taxes, blocking later costs and you will legal issues.

- All the way down Interest rates: Generally, money covered facing domestic guarantee possess down rates compared to the signature loans otherwise handmade cards.

- Flexible Fees Preparations: This type of financing usually come with versatile repayment solutions, which makes it easier to manage your bank account.

The whole process of Making an application for Home Security Resource

Making an application for domestic collateral funding is a straightforward processes, especially with advantages such as those at . Listed here is a simple definition:

- Evaluate Your Guarantee: Determine how much guarantee you really have of your home. This can be done that with property collateral calculator .

- Choose the right Equipment: Determine whether or not good HELOC otherwise home guarantee financing is best suited for your own requires.

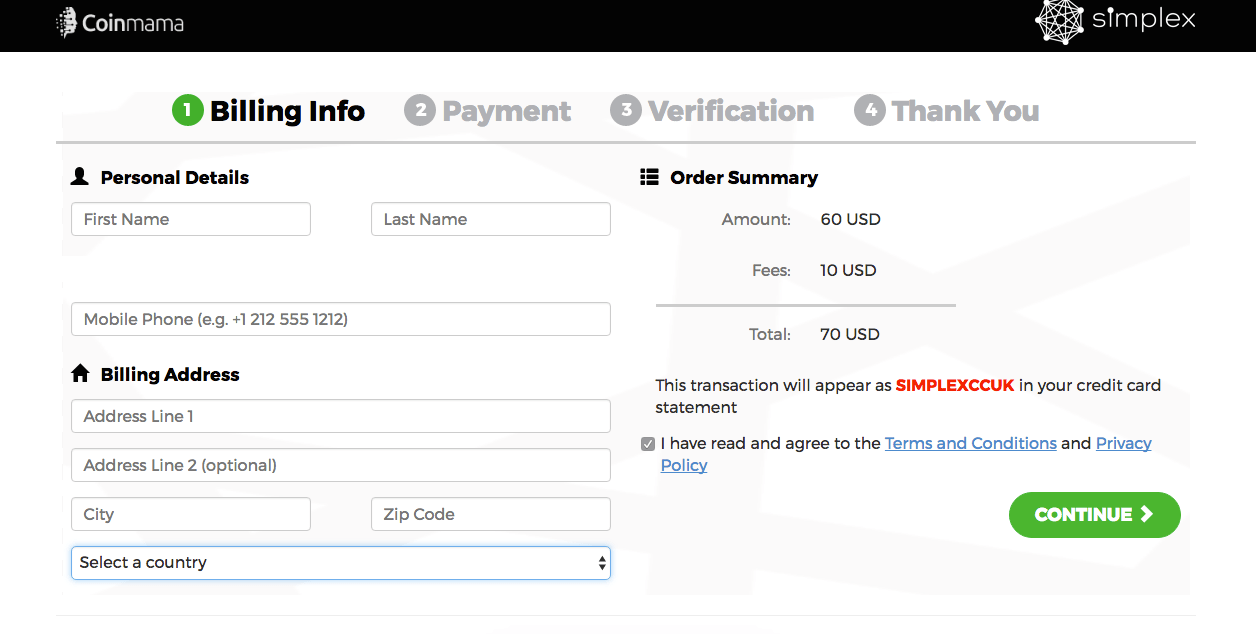

- Application: Done a loan application, providing required monetary info.

- Acceptance and you can Access to Money: Shortly after accepted, you need the amount of money to repay your property income tax statement.

specializes in enabling homeowners as if you availableness home guarantee investment, inside tricky factors. If antique loan providers possess turned you away, could possibly offer solution choices. The help of its assistance and comprehension of the fresh new Canadian housing market, capable show you from the procedure, guaranteeing you will be making an informed choice for your financial situation.

Immediately following solving your own immediate taxation issues, its essential to take control of your funds to avoid future items. Think about the tips below:

- Do a spending plan: Tune your income and you can expenditures. Prioritize property tax repayments to get rid of upcoming troubles.

- Arrange for Possessions Tax Repayments: Arranged financing regularly to fund your house fees.

- Demand Financial specialists: Advisors from the can offer knowledge for the controlling your home equity financing and complete economic fitness.

Assets income tax demands is daunting, however with just the right method, these include in check. Family security resource has the benefit of a functional option to clear the taxation dues and get away from courtroom dilemmas. is your own partner inside navigating such financial difficulties, giving customized recommendations and solutions.

Contemplate, getting hands-on strategies now is also secure your financial balance tomorrow. Don’t let assets income tax demands overwhelm you explore the choices or take power over your financial coming.