What is an ending Revelation?

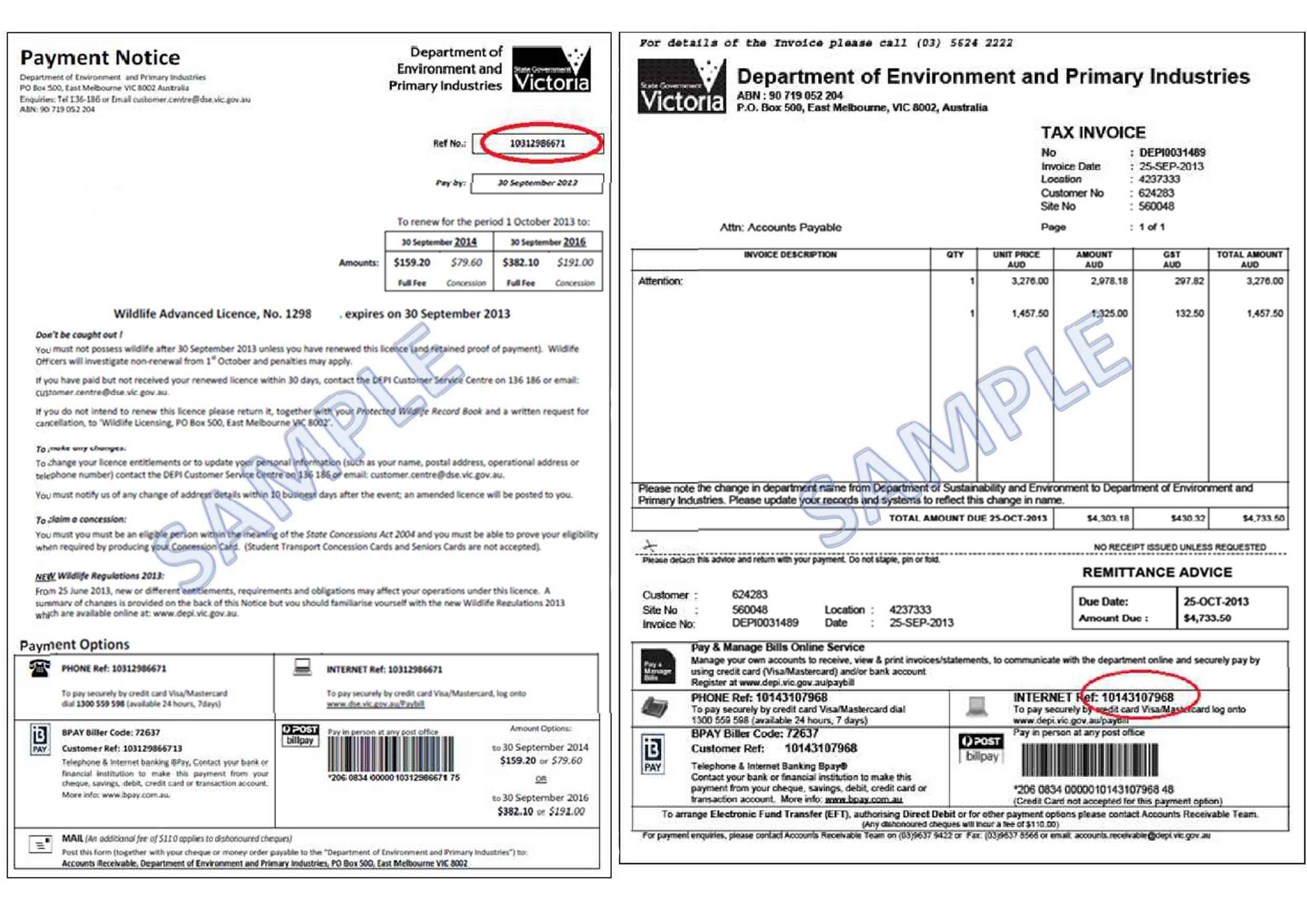

A closing Disclosure (CD) was a good four-page setting that give the past information regarding your home loan. It provides your very own suggestions, the borrowed funds conditions, your own estimated payment per month number, and how far you are going to pay within the charges.

Legally, your lender need provide the Closure Revelation at least around three working days before you can romantic on the financing. It is referred to as three-day laws which can be designed to make you plenty of time to opinion your finally terminology and you may costs compared to the the loan Estimate, as well as time and energy to pose a question to your financial inquiries before heading into closing table.

You would not located a closing Disclosure when trying to get all type of financial, although not. Reverse mortgage loans, house equity personal lines of credit (HELOC) and you may are produced homes loans try one particular which come in place of a beneficial Computer game, based on Simental.

As to why Closure Disclosures matter

While purchasing a new domestic or refinancing your existing financing, the new Closing Disclosure enables you to compare the genuine loan words as to what you expected. Once you sign one to, youre investing the fresh requirements showed at hand.

The Video game guarantees your bank provided you with your financial suggestions and you may what you fits their totally new offer, so it’s important to peruse this file cautiously. It is awesome, extremely essential that you discover all the terms of your loan prior to signing thereon charming dotted range, Simental shows you.

Its awesome, loans in Moody without credit checl extremely essential understand all of the regards to your loan before signing on that charming dotted range.

Instance, can be your interest like everything were quoted in the beginning of your app procedure? Any kind of charges you used to be unaware of otherwise commonly going become truth be told there?

When the that which you happens predicated on package, the borrowed funds recognition, home assessment, insurance policies and you may formula of all of the third party charges is finished until the Closing Disclosure was issued to you. The new Closure Disclosure is going to be daunting to examine, specifically if you have no idea what you are seeking. While you are playing with a representative, capable let discuss it with you.

Ensure that the Closure Revelation is most beneficial when you sign

When you found their Closure Disclosure, you should understand your balance within closing as well as your month-to-month home loan fee number. When you signal the revelation, your bank cannot replace the home loan terminology.

not, you might still opt out of the financing for many who transform the head. If you ages for the credit file should you choose thus.

If you find an error on revelation, get hold of your bank, escrow representative otherwise settlement broker as quickly as possible to have it remedied. Things have becoming best about file, Simental says. Also some thing since apparently easy and harmless once the an excellent misspelled name otherwise home address. All errors can result in delays in conclusion.

- Ask observe the data files ahead. Double-read the loan information and your personal data

- Inquire to everyone with it and make sure he has exactly what they want. Concern anything that looks weird or if you hardly understand

- Speak to your closure agent better just before your planned closing to ensure that you learn that is responsible for what

- Origination, running and you will underwriting was standard fees loan providers costs. Watch out for miscellaneous rubbish charges. If it ends up it must not be around, odds are it might not must be

The bottom line on Closure Disclosures

It could feel only foregone conclusion to help you easily indication before getting into your new domestic, although advice regarding the Closing Revelation should be flawless. Problems can be end up pressing straight back the closing and you can move-when you look at the time.

So realize their Closure Revelation very carefully to ensure all of the terminology try proper. Just in case the truth is things you will be not sure with the, only ask your lender otherwise agent for help.