To invest in property is a huge lifestyle event. To ensure that you start your own travels off to the right base, there is make several things you ought to would just before you action into your very speedycashloan.net loans with no income first unlock family.

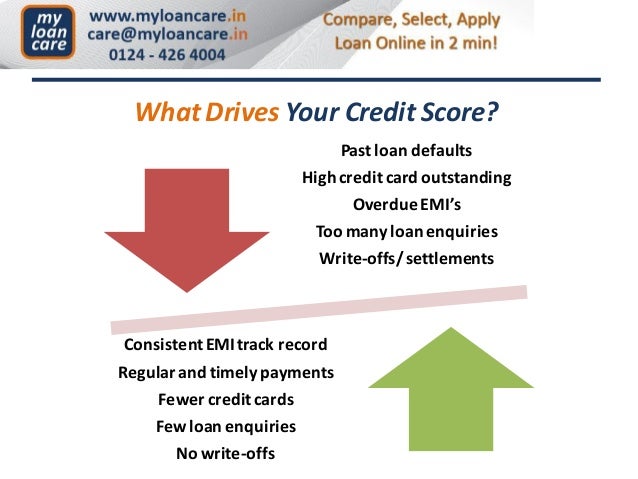

Check and replace your borrowing from the bank scoreYour credit rating (both titled a beneficial FICO rating) is employed by the mortgage lender to determine while you are eligible to discovered that loan and you may, when you are, the speed you are getting. Results range between three hundred and you may 850 the higher the newest score, the higher. It is not impractical to get a property, but you’re struggle. Realize about purchasing property having challenged borrowing. As a whole, the low their rating, the better down payment your mortgage company may require.

Look at the score free-of-charge once a year on annualcreditreport. When it is reduced, you need time for you raise they. You could start performing the next:

It’s never a pledge of a loan, however it is much better indication (for both both you and the individual you happen to be to invest in from) you will be longer a loan if you make a deal toward property

- Without having a credit history, get one. Take-out credit cards and make your repayments on time to show you will be credit-deserving. Without a credit score can provide you with a very reduced credit history.

Its never a pledge regarding a loan, but it’s best indication (for you and the person you will be to order off) you will be lengthened a loan if one makes an offer towards a property

- If for example the playing cards try maxed (or almost maxed) you’ll want to begin paying them off. Playing with too much of their readily available credit can reduce your credit score.

It is never ever a guarantee off a loan, but it’s better indication (for both both you and anyone you happen to be to shop for from) that you’ll be prolonged a loan if you make a deal on the a house

- Pay the bills promptly. Should your repayments feel 30-days past due they are going to be advertised for the borrowing from the bank agency and lower your credit score.

In the event your rating are significantly less than five hundred, you have got what is entitled confronted borrowing

Choose in which you want to liveDo we want to remain in the city, condition, otherwise county you are in? Take a little time to research the options and make sure you realize where you wish to be for another couple decades.

Contact a local mortgage lenderWorking having a property professional that contacts in the region is always recommended. Might understand local and you can state first-day resident and you may downpayment guidelines apps that save you a lot of money that is plus all national financing and you can assistance programs. To one another, might discuss the borrowing, earnings, and you can monetary desires to discover the best mortgage.

Rescue for the off paymentThe amount you should save your self to own a deposit depends on the type of mortgage you choose as well as your financial predicament. It does start around 0% of one’s complete price for a beneficial Virtual assistant financing to since the much as 20% or maybe more getting traditional otherwise jumbo funds. A lot of people accidently assume you usually need 20% as a result of get a property, which will be just not your situation.

People may decided to place normally down that you can although some have a tendency to put the lowest down. That is effectively for you? Your loan manager may go through the positives/disadvantages each and every circumstance so you can choose.

Rating pre-approvedBeing pre-accepted setting your financial has already looked at your revenue, assets, financial obligation, and credit report to choose just how much they truly are happy so you can provide your.

See a real estate agent to show youOnce you are an individual, representatives possess a fiduciary obligations to you. That means he is legally forced to put your needs earliest. They are going to know very well what to look for that have a property and you can area, might make it easier to negotiate the cost, and they’ll help you navigate the new paperwork and you may legalities which have and then make an offer and purchasing property.