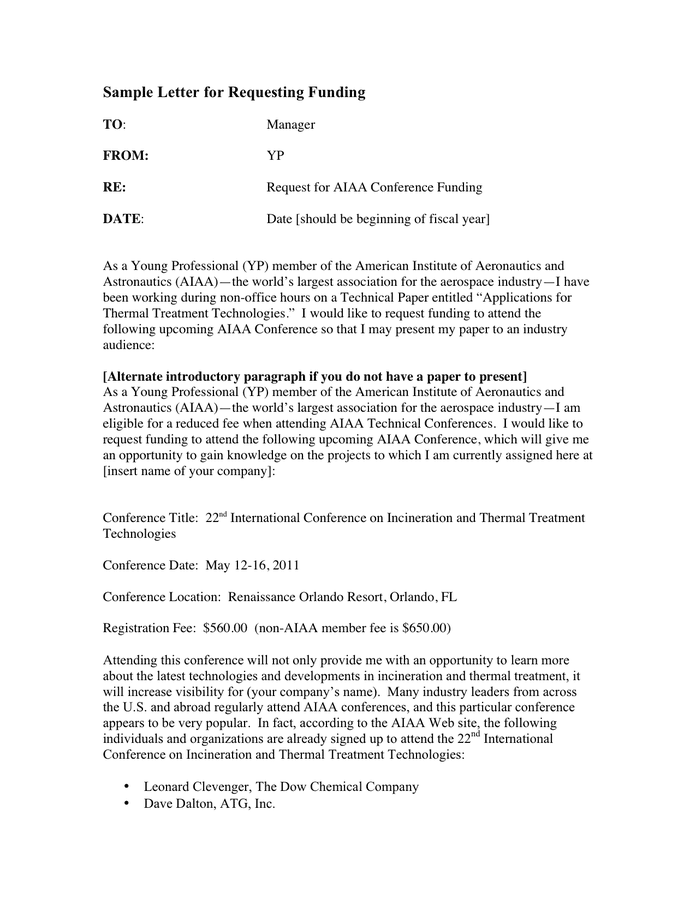

The application form aims to help qualified homebuyers by giving all of them competitive interest levels, lower down percentage requirements (as little as 3%), plus versatile borrowing laws. HomeReady also helps handicapped borrowers if you take into account low-conventional money present such Social Cover and you can long-title disability masters.

Thus, whenever you are seeking regulators mortgage brokers having handicapped consumers, an FHA financing are an effective option

- A credit rating regarding 620 or maybe more

- No less than good 3% deposit

- Low- to modest-earnings (just about 80% of the area’s average earnings)

- Need certainly to undertake the house once the an initial home

In reality, Societal Cover Disability Insurance coverage (SSDI) and Extra Coverage Insurance (SSI) try both acceptable income offer toward HomeReady mortgage system

Thankfully that deposit money does not have any to recover from your own deals. HomeReady lets you safeguards the entire deposit having fun with downpayment recommendations finance, currency gifted out of a close relative or caretaker, otherwise housing gives for people with disabilities. Continuar leyendo «Federal national mortgage association will not underwrite HomeReady finance actually»