Whenever a lender denies someone’s app having an auto loan, its prominent to put the brand new fault into the bad credit. But that is not the sole end in. Your job situation may additionally prevent you from providing accepted to have a car loan.

Your work reputation brings lenders ideas on how you is also handle financing, regardless of if it is far from the actual only real grounds. And it’s not a secret one to particular business facts is faster most readily useful as opposed to others. All things considered, you’ll find four employment things that could bring about car finance disapproval.

Decreased income

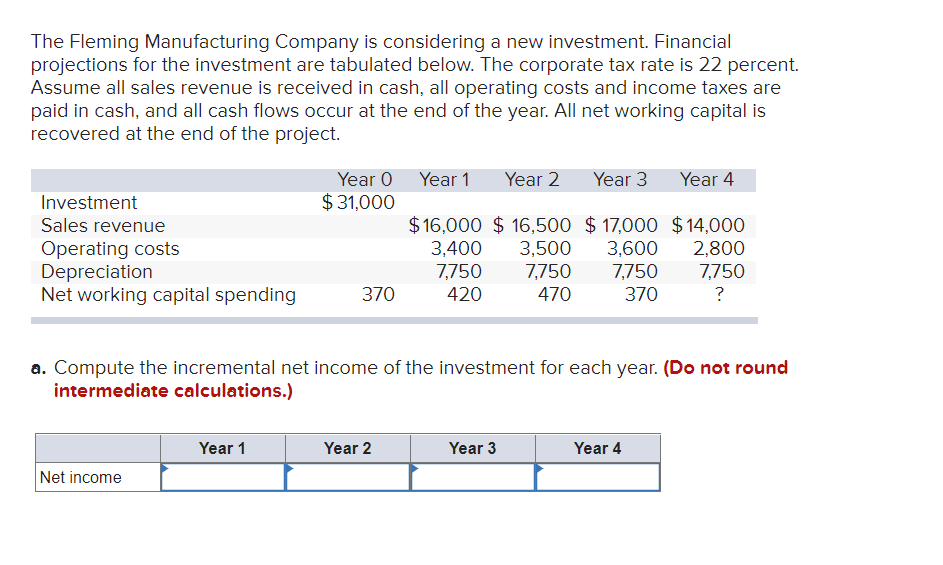

Your income usually does not connect with your approval having an auto loan an excessive amount of. However, that doesn’t mean lenders never ever consider it. Based on the count additionally the period of your vehicle mortgage identity, a loan provider get deny you a loan since your money is also low.

They will assume that your earnings can lead to challenging to make costs and you can refuse your this is why. Continuar leyendo «Place of work Blues: 4 Occupations Facts that may End in a car loan Getting rejected»