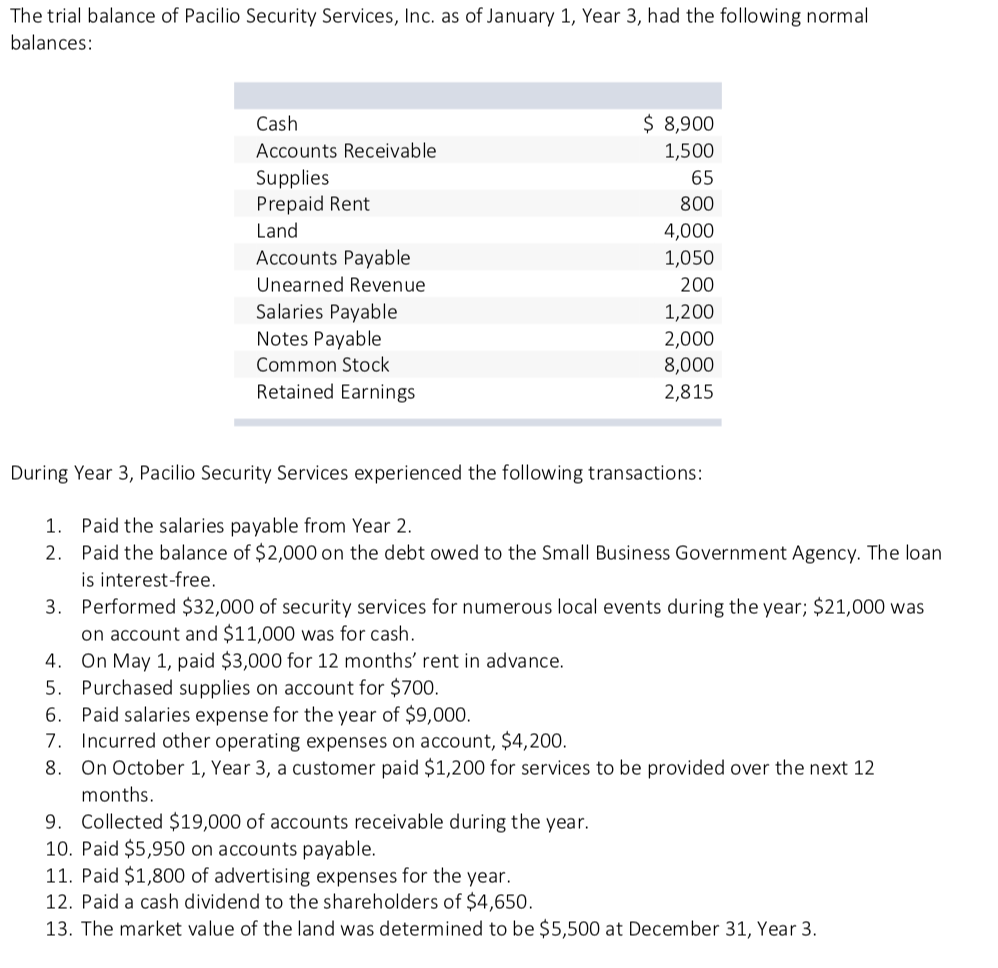

That have mastercard rates of interest cracking several information to date which season and costs for the signature loans really into twice digits, household guarantee credit is just about the clear better substitute for of many borrowers at this time. With interest rates averaging not as much as 9% for both domestic collateral loans and you may household equity personal lines of credit (HELOCs) , property owners possess a fees-effective way so you can borrow a big amount of cash.

Which profile is relatively high. The modern household security number is actually averaging slightly below $330,000 already, leaving many homeowners which have a six-shape sum of money to utilize because they find complement. Having said that, the latest timing out of property equity application for the loan is essential so you can rating proper, eg now just after an interest rate reduce was just issued and you may pursuing the newest rising cost of living reading demonstrated they rising again. Continuar leyendo «Given with your house security now? Pros and cons out-of acting just before 2025»